As you navigate the complex world of investments, you’re likely no stranger to the challenges of making informed decisions amidst fluctuating market conditions. That’s where AI trading signals come in – a game-changer for investors seeking to stay ahead of the curve. By harnessing the power of advanced algorithms and real-time analysis, you can tap into hidden market trends and make data-driven investment decisions. But how do these signals work, and what benefits can you realistically expect to gain from integrating them into your investment strategy?

How AI Trading Signals Work

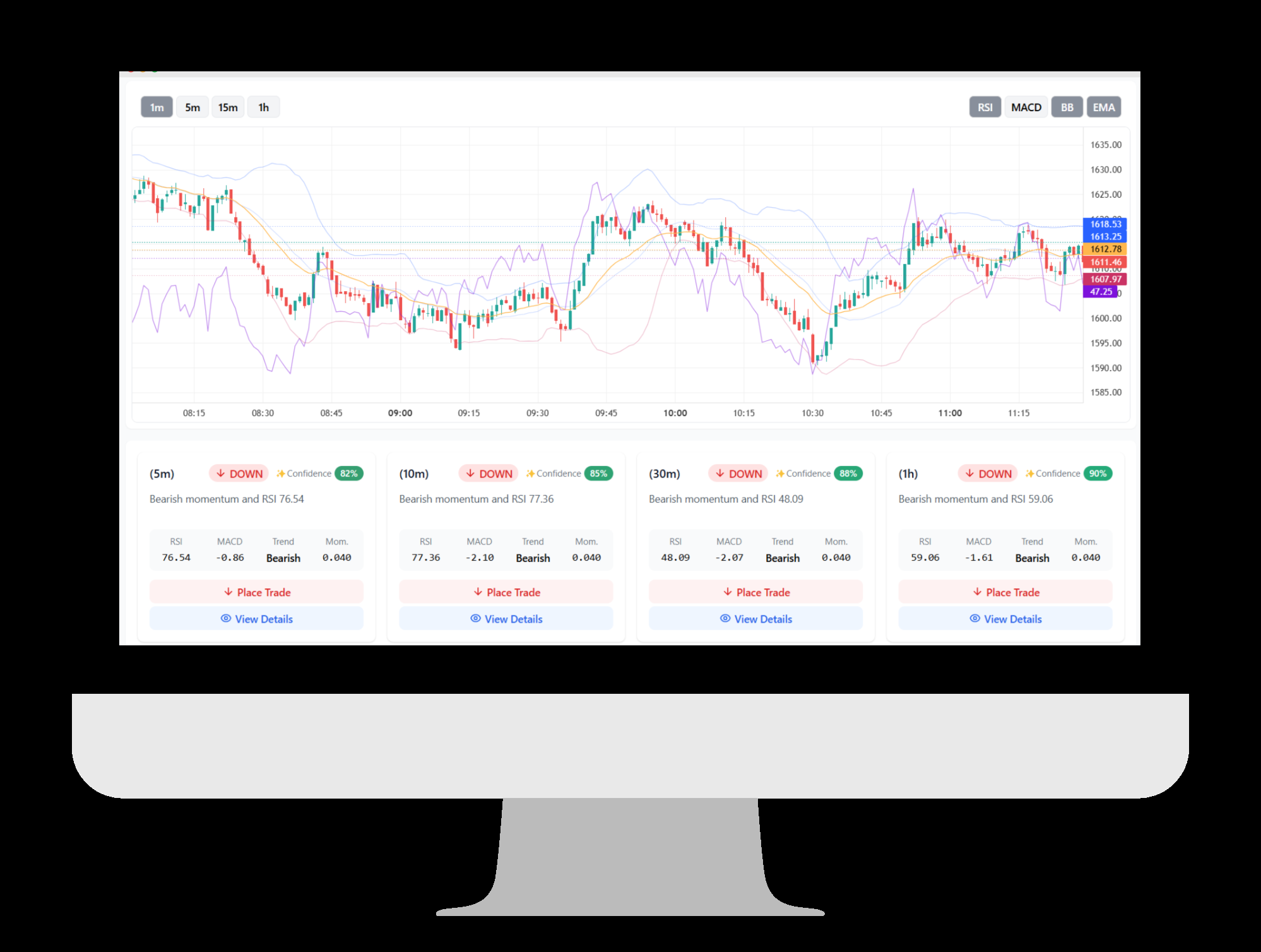

When you subscribe to an AI AI signals signal service, you’re essentially tapping into a sophisticated system that analyzes vast amounts of market data in real-time.

This system is powered by advanced algorithms that continuously scan the markets, identifying patterns and trends that can inform your investment decisions. These algorithms are trained on historical market data, allowing them to recognize and adapt to changing market conditions.

The AI system processes this data at incredible speed, generating trading signals that are designed to maximize your returns.

These signals can be used to execute trades automatically or serve as recommendations for manual trading. The system’s real-time analysis enables you to respond quickly to market shifts, reducing the risk of losses and increasing the potential for gains.

Benefits of Real-Time Insights

By tapping directly into the AI system’s real-time insights, you gain a significant edge in the market, allowing you to respond swiftly to emerging trends and shifting market conditions.

This enables you to capitalize on opportunities as they arise, rather than reacting to yesterday’s news. With real-time insights, you’re better equipped to manage risk and make informed investment decisions.

You’ll be able to identify potential pitfalls and adjust your strategy accordingly, minimizing losses and maximizing gains.

Moreover, real-time insights provide you with a more accurate picture of the market, helping you to cut through the noise and focus on what really matters.

This clarity of vision allows you to refine your investment strategy, making it more targeted and effective. By staying ahead of the curve, you’ll be able to adapt quickly to changing market conditions, ensuring your investments remain aligned with your goals.

With real-time insights, you’ll be more confident in your investment decisions, knowing you have the most up-to-date information at your fingertips.

Identifying Hidden Market Trends

You’re now empowered to make informed investment decisions with real-time insights, but that’s just the starting point.

The real value lies in identifying hidden market trends that others may miss. With AI trading signals, you can uncover these trends by analyzing vast amounts of data in real-time.

This allows you to spot subtle patterns and correlations that may indicate a shift in the market.

By identifying these trends early, you can adjust your investment strategy to capitalize on emerging opportunities or mitigate potential risks.

AI trading signals can help you identify trends in various markets, from stocks and bonds to commodities and currencies.

You’ll gain a deeper understanding of market dynamics and be able to make more informed decisions.

Moreover, AI trading signals can help you identify trends that may not be immediately apparent.

For instance, you may uncover a correlation between a particular economic indicator and a specific stock’s performance.

This kind of insight can give you a competitive edge in the market, enabling you to make smarter investment decisions.

Data-Driven Investment Strategies

AI trading signals empower you to develop data-driven investment strategies that eliminate emotional bias and guesswork.

By leveraging real-time market insights, you can create informed, evidence-based investment decisions that drive long-term growth. With AI-driven analysis, you can identify patterns and trends that might elude human observation, allowing you to capitalize on opportunities and mitigate risks.

You can refine your investment approach by backtesting strategies, evaluating performance metrics, and adjusting your portfolio accordingly.

This data-driven approach enables you to adapt quickly to shifting market conditions, ensuring your investments remain aligned with your goals. Moreover, AI trading signals help you diversify your portfolio, reducing exposure to specific assets and minimizing potential losses.

Maximizing Returns With AI

Two key factors drive successful investing: identifying profitable opportunities and timing trades perfectly.

You’ve likely experienced the frustration of missing out on a lucrative trade due to poor timing or investing in a stock that fails to perform.

This is where AI trading signals come in, helping you maximize returns by identifying high-potential trades and optimizing your entry and exit points.

By leveraging machine learning algorithms and real-time data, AI trading signals can analyze vast amounts of market information to identify profitable trades that you might otherwise miss.

You’ll receive alerts and insights that enable you to make informed investment decisions, reducing the risk of costly mistakes.

With AI-driven trading signals, you can refine your investment strategy, capitalize on market trends, and increase your returns.

Conclusion

You’ve got the power to make informed investment decisions with AI trading signals. By leveraging real-time insights, you can capitalize on emerging trends, manage risk, and drive long-term growth. With AI-driven analysis, you’ll eliminate emotional bias and refine your investment approach. Now, you can respond swiftly to market shifts and maximize returns. It’s time to take control of your investments and unlock your full potential with AI trading signals.